My FTMO Challenge Story

I recently found out about prop trading and quickly signed up for my first FTMO challenge.

Prop trading allows you to prove yourself on a demo account, then get funded by a company, allowing you to trade with their capital instead of your own.

I was intrigued by the idea, since I’ve become a more profitable and consistent trader over the past year.

My first Challenge

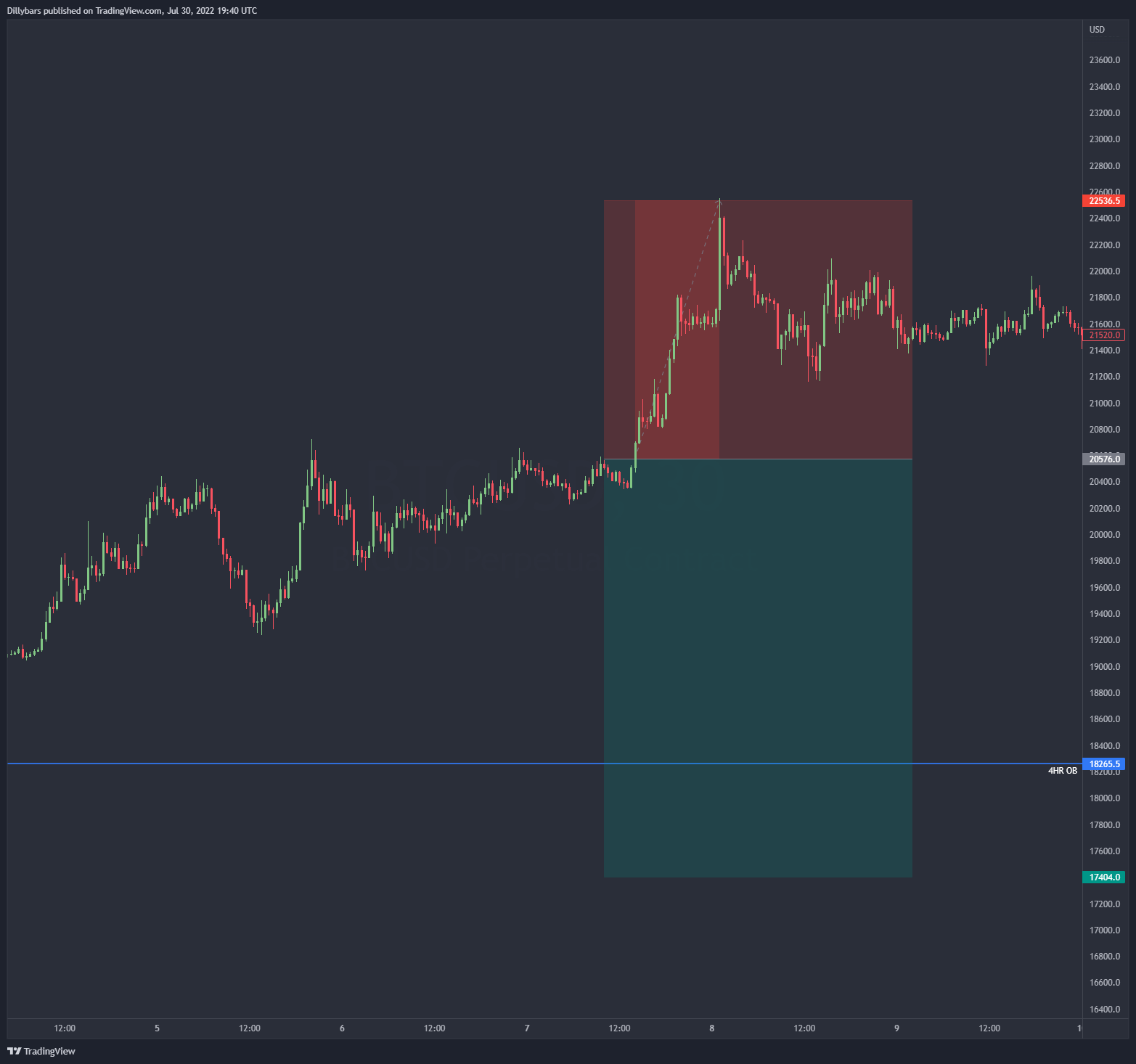

I decide to try their smallest challenge, $10k, to see how the system works and get used to trading in ancient interfaces like MT4. I’m glad I did. I quickly entered a short position on a Friday afternoon, but didn’t set a stop loss, thinking that my small position size was safe. Bitcoin proceeded to move $2000 against me.

I was expecting MT4/FTMO to stop me out when I hit my daily loss limit, but I should have read the FAQ. There is no warning in either app, until you’ve gone past your limit for the day. A learning experience.

After losing that challenge, I still traded the demo account for a few days and was able to hit the profit target. Doing this allowed me to get acquainted with the archaic MT4 system.

My second Challenge

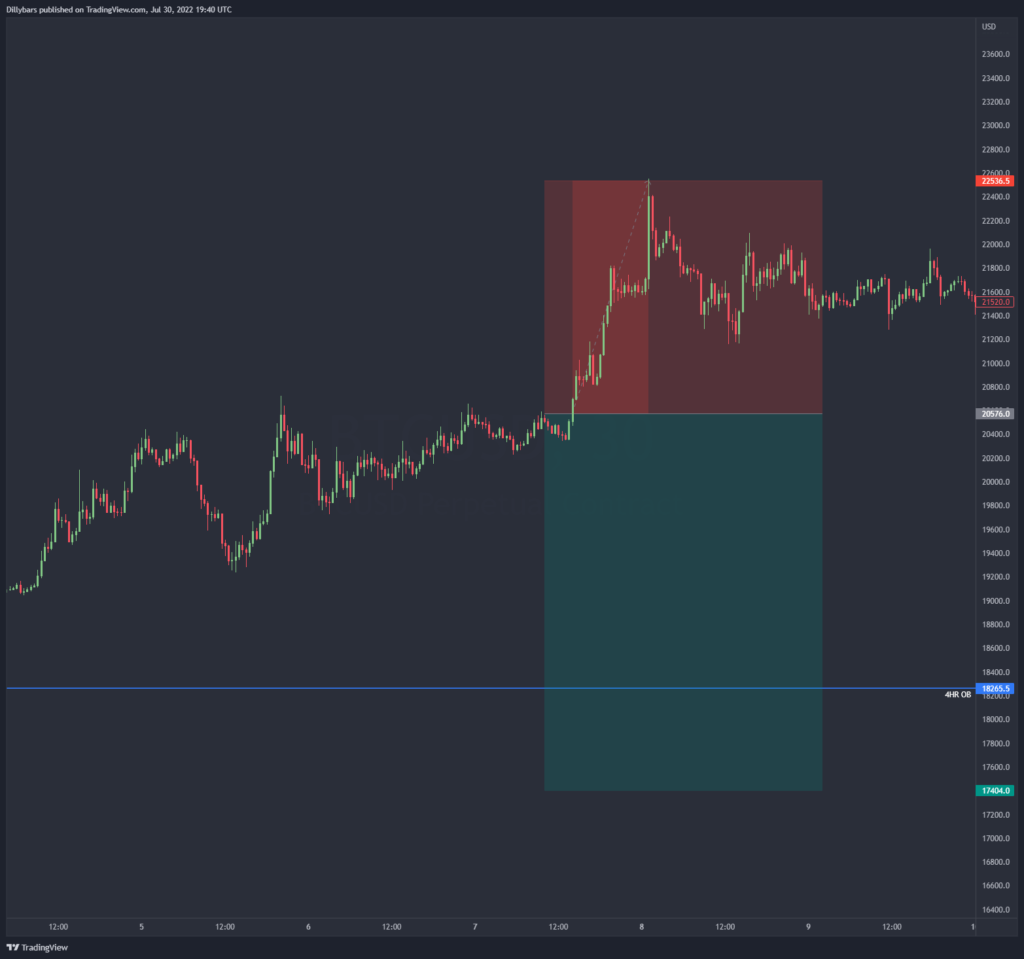

This time, I decided that the higher risk account would better fit my trading style. This was a mistake. It allowed 2x the daily loss and I traded like I needed to test those limits.

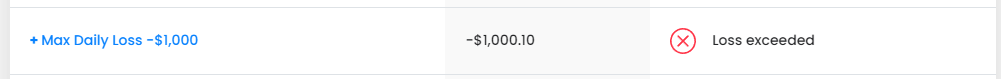

I came out swinging, was near the profit goal within a few days, but miss-calculated a stop loss on a trade.. and missed the daily limit by $0.10

That one stung, but it was a great reminder to stop taking dumb risks. There is no need to be anywhere near that daily loss limit. I was overleveraging and it showed.

My Third Challenge

This time I upped the risk and went for the $25k account. I wanted to feel some sort of repercussions if I traded poorly. I also wanted a worthwhile reward for trading smart. My main concentration this time was not on technical analysis or sniper orders, but simple risk management.

That’s my current Status

I’ve passed the challenge, now I’m in the verification stage. Verification gives you twice as many days (60!) to make half as much profit. This should be a simple task, if I continue to concentrate primarily on risk management.

How to Pass the FTMO Challenge

This is quite simple. You should have the basics of trading down. You need to have a system for establishing a bearish/bullish bias, looking for entry points, knowing your invalidation point for the trade, etc.

The most important aspect is not the trading system you establish. It’s simple risk management.

If you can keep your losses small, hopefully significantly smaller than your winning trades, your trading system could literally be flipping a coin.

Having the self-control to use a stop loss, don’t double down when the trade is going against you, don’t move your stop loss just before it hits.

Use the losing trades as learning opportunities. Try to understand why you were wrong. Don’t make the same mistakes repeatedly.

A huge point, don’t risk too much of your account on each trade. 1% per trade could be too much. You’ll be much more safe only risking .25%-.5% of your account on each trade and slowly building profit over the month.

There is no need to try to pass the challenge in 1-2 trades.

This should probably not need to be said, but don’t use one of the services that promises to pass your FTMO challenge. If you can’t pas the challenge yourself, there is no use in having a funded account. You won’t be profitable with real money if you aren’t profitable in the demo.